Concerns over hot economic growth and inflation hit the American stock market Monday. There’s debate over whether it’s a reaction to a COVID-19 resurgence or a backlash to inflation.

Summary

Apparent unease over a small resurgence in COVID-19 infections resulted in stocks taking a tumble Monday, with the Dow losing more than 700 points.

- Despite the concern over the uptick, the current rate of infections are “still well below highs from last fall and earlier this year.”

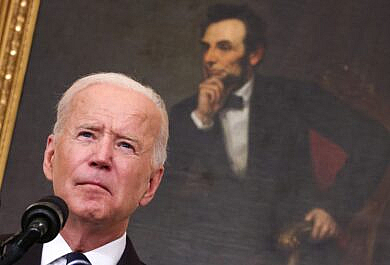

- In remarks at the White House, President Biden argued the economy is booming rather than suffering from inflation, and lobbied for passage of infrastructure and stimulus spending legislation to continue the gains.

- It was reported last week that inflation on consumer goods hit a 13-year high of 5.4% last month.

- Senate Republicans are expected to vote no on a procedural vote to begin considering an un-finished infrastructure bill negotiated by a bipartisan group of senators.

![]()

- CNN highlighted Biden’s efforts to rebut criticism of his administration’s handling of the economy, arguing the fits of inflation since he’s taken office are to be expected when you “flip the global economic light back on.”

- The Washington Post provided anecdotes from the restaurant industry on inflation’s effects, noting increased prices and wage demands forced one restauranteur to raise his prices twice since March.

- NBC News’ report on the stock downturn played up fears over the coronavirus resurgence in the top of the article, but failed to mention the concern over inflation—with quotes from actual economic experts—and how it is affecting the markets.

![]()

- National Review’s coverage of Biden’s Monday press conference focused on his insistence that his infrastructure and stimulus bills, introducing more money into the economy, “will be a force for achieving lower prices for Americans looking ahead.”

- Biden’s deflection on a question about inflation was the headline for the Washington Examiner, in which Biden took a jab at former President Trump over his predecessor’s penchant for using stock prices as an indicator for economic health.

- OANN’s broad look at Biden’s remarks included caution from a former International Monetary Fund official who said without the proper taxation and restraint in further spending, Biden’s “infrastructure plan and families plan” will “be adding to the inflationary pressures.”

Author’s Take

There are two reasons for cause for concern over the economy, and which one you believe depends on which camp you’re in: The media and Democrats wants you to believe it’s all about a resurgence in the coronavirus and hesitancy among the economic elite in its wake. Meanwhile conservatives think additional government spending has introduced too much money into the economy, particularly with respect to the labor market and the demand for workers.

The reality is probably somewhere in the middle, and global vaccination rates might have more to do with it than people realize: While the United States was one of just a handful of countries to zoom ahead in its vaccination program, most other nations did not have that head start. Perhaps the uneven vaccination rates in countries the United States relies on for trade have begun to act as a small drag on the American economy?

© Dallas Gerber, 2021